It has been said there are two certainties in life: death and taxes. These days another certainty can be added to the list: a reduction in the federal funds rate at the July Federal Open Market Committee (FOMC) meeting. According to the CME Group’s FedWatch Tool, futures traders are pricing in a 100% probability that the federal funds rate will be reduced at the July FOMC meeting. As of July 6th, the probability of a .25% reduction in the federal funds rate is 95.1% and the probability of a .50% reduction is 4.9%. This degree of market certainty stems from concerns about slowing U.S. and global economic growth primarily due to heightened trade and tariff frictions. In addition, recent dovish comments from the Federal Reserve (Fed) have led market participants to believe additional monetary support will be forthcoming. In effect, the market is looking for insurance in the form of preventative monetary policy to blunt any adverse economic developments that may unfold.

While the reasoning in support of a reduction is logical, to a certain extent, a reduction at this point may be premature given current economic conditions and the history of past reductions in the federal funds rate. A reduction in advance of a more material downturn in the economy presents risks should economic growth reaccelerate. These two opposing forces – market expectations and the economic data – put the Fed in a quandary. A failure to reduce the federal funds rate will disappoint market participants and may leave the economy vulnerable to adverse economic developments. A reduction in the federal funds rate will satiate market participants but may complicate economic policy down the road.

The U.S. economic data over the last several months has been mixed, but still consistent with economic expansion and GDP growth. Manufacturing data has been weak with the ISM Manufacturing Index declining to 51.7% in June from 52.1% in May. The ISM Non-Manufacturing Index (services) also weakened slightly in June, declining to 55.1% from 56.9% in May. However, both ISM indexes are still above their respective breakeven lines indicating continued expansion in both the manufacturing and non-manufacturing sectors. On the brighter side, the labor market has been a source of strength with 224,000 jobs added in June. The unemployment rate remained at a historically low 3.7% and average hourly earnings increased 3.1% year-over-year. As for Q1 GDP, real GDP growth increased at an annual rate of 3.1%, much stronger than originally expected. Measures of inflation have been subdued. The CPI increased .1% in May (1.8% year-over-year) and the core CPI increased .1% in May (2% year-over-year). Lastly, the Conference Board’s Leading Economic Index has been holding steady around the 111 level, indicating continued economic expansion.

Given the economic data discussed above, a reduction in the federal funds rate may be premature. The example most widely cited as a precedent is the 1995 reduction that occurred under then Fed Chairman Alan Greenspan. Given a slowdown in economic activity in 1995, the federal funds rate was reduced by .50% in 1995 to stimulate the economy ultimately producing a soft landing (the federal funds rate was reduced by .25% on July 6th, .25% on December 19th, and .25% on January 31, 1996). Briefly reviewing several of the economic indicators noted above, it is evident the slowdown that occurred in 1995 was more severe than the slowdown taking place today.

I) Real GDP

Looking at the 1995 chart, it is evident a material slowdown in real GDP growth occurred just prior to the fed funds rate reduction in July 1995. Real GDP growth declined quite substantially, from an annual rate of 4.7% in Q4 1994 to 1.2% in Q2 1995, a reduction of 3.5%. This type of rapid decline certainly supported a reduction in the federal funds rate. The data we see today is not as dramatic. After declining from an annual rate of 4.2% in Q2 2018 to 2.2% in Q4 2018, real GDP growth has bounced back to 3.1% in Q1 2019. If anything, the federal funds rate should have been reduced at the January FOMC meeting. Rather, the federal funds rate was maintained at its current target range of 2.25%-2.50% (and real GDP growth increased to 3.1% in Q1). Based on the data, a reduction was justified in 1995. Today, the case is not as clear.

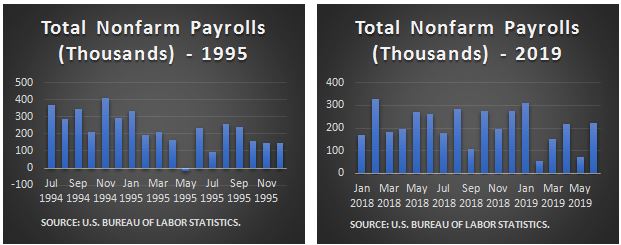

II) Nonfarm Payrolls

Looking at the 1995 chart, a slowdown in nonfarm payrolls was evident in early 1995 as compared to late 1994 levels. The loss of 20,000 jobs in May 1995 is especially notable given the strength seen in prior months. The data today does not appear as weak. The most recent June employment report was quite strong with 224,000 jobs created. A reduction in the federal funds rate does not appear justified based on the nonfarm payroll data.

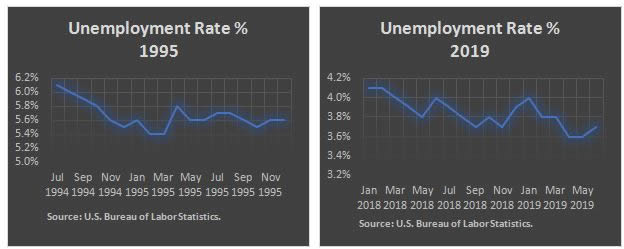

III) Unemployment Rate

As was the case with the nonfarm payroll data, the unemployment rate also does not provide much justification. Just prior to the reduction in 1995, the unemployment rate increased quite substantially from 5.4% in March 1995 to 5.8% in April 1995, an increase of .4%. Typically, increases of this magnitude are harbingers of an eventual recession. After the spike to 5.8%, the unemployment rate declined to 5.6% until the reduction in July 1995. Today, the unemployment rate is still at a historically low level of 3.7%. Like the case made for real GDP, a reduction in the federal funds rate would have made more sense in January given the increase in the unemployment rate of .3% from September 2018 to January 2019.

In the Odyssey by Homer, Odysseus must make a choice between the two dangers posed by Scylla and Charybdis. Scylla is described as a six-headed monster that devours a sailor for each one of its heads. Charybdis is described as a whirlpool that can swallow an entire ship. Obviously, each one of these options is not desirable, but a choice and a sacrifice must be made. Ultimately, Odysseus chooses to pass by Scylla sacrificing six of his men in order to save the ship.

While the choice the Fed must make doesn’t involve a six-headed monster or a whirlpool, a choice must be made and with this choice comes sacrifices and consequences. Based on the economic data reviewed, a reduction in the federal funds rate may be premature at this point. Real GDP growth, nonfarm payrolls, the unemployment rate and other economic indicators all point to continued economic expansion. The reduction in the federal funds rate that took place in 1995 was in the face of a more material decline in the economic data. However, in many ways, the economic environment of today poses more acute challenges. As such, while the past serves as a useful guide, policy should not be dictated by the past. Given today’s challenges, a flexible and even unconventional policy toolkit is sensible. With risk elevated and inflation low, a reduction in the federal funds rate of .25% may be passing by Scylla.

As we move forward, the incoming economic data and comments from Fed officials will be critical to determine the future course of monetary policy. As for the financial markets, the U.S. equity markets have been performing well with the major U.S. indexes trading near all-time highs. The U.S. fixed-income markets have also been performing well as interest rates have declined. As for our outlook, we are still positive on U.S. and select foreign equity markets. The U.S. economy is still growing, albeit at a slower pace, and the probability of a recession is low.

Raskob Kambourian Financial Advisors is an independent, fee-only comprehensive financial advisory firm registered with the Securities and Exchange Commission. We offer expertise, competitive pricing, and personalized financial services to meet your “Life Planning” needs.